Personal Loan Explained Online SBI Personal Loan YouTube

Open the app & click on 'Personal Loan'. Choose the Personal Loan scheme that you have availed and click on 'Next'. Click on 'Menu' on the top left side of the app. On the drop-down bar, click on 'Track Application'. Enter your loan application reference number and mobile number registered with the bank to check the status of your personal loan.

SBI Personal Loan sbi loan apply online sbi bank se loan kaise le 2023 Sbi bank loan

SBI personal loans are quick and easy to apply for online. (REUTERS) SBI personal loan requires you to be between 21 and 58 years old, employed in a stable job, and have a good credit.

SBI Personal Loan 9.85 Interest Rate Eligibility & Apply Online

₹ Rate of interest (p.a) % Loan tenure Yr Principal amount Interest amount Your Amortization Details (Yearly/Monthly) SBI Personal Loan EMI Calculator: Calculate Your SBI Bank Personal Loan EMI Online The Indian economy is currently going through a phase of strong-rooted financial growth, encouraging individuals and entities to spend more.

SBI Personal Loan Apply Online 2021 / Upto 5 Lakh Loan Only 10 Minutes Credit In You A/C Instant

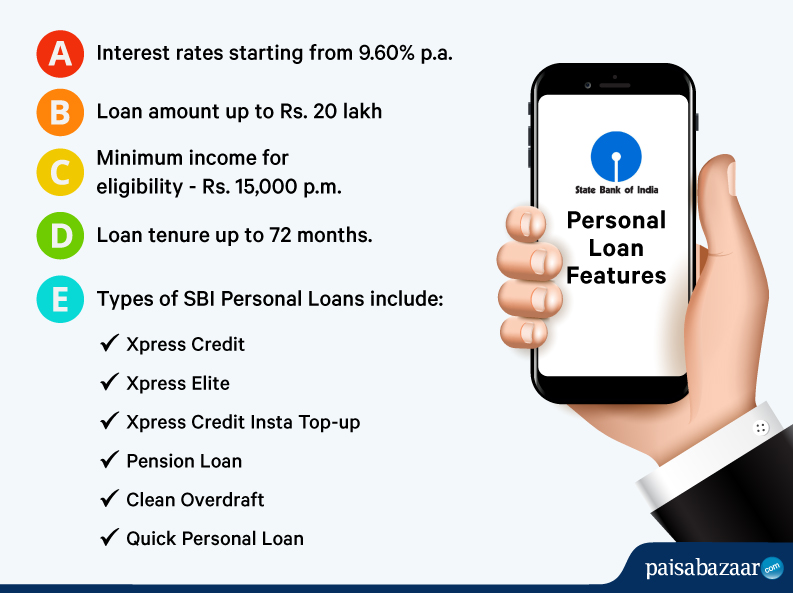

State Bank of India Personal Loan is offered @ 10.55% p.a. onwards for loan amount of up to Rs 20 lakh and tenure of up to 6 years. The bank also offers pension loan of up to Rs 14 lakh for tenure of up to 7 years. Select existing customers of State Bank of India can also apply for SBI Pre-approved Personal Loan online through SBI YONO app.

sbi personal loan online apply 2022 sbi yono pre approved personal loan SBIPersonal Loan

By using the following steps, you can track your personal loan application status: Step 1: Go to the official website of Afinoz. Step 2: Navigate to the right corner and click on the 'Track Application' tab. Step 3: You will be redirected to a new page where you will be required to enter your 'Application ID'.

SBI Loan EMI Calculator से कैलकुलेट करें SBI personal loan EMI calculator

State Bank of India offers several personal loan schemes to customers; some popular ones are SBI Pension Loan, Xpress Credit Loan, Xpress Elite and Pre-approved Personal Loans. Funds availed with an SBI Personal Loan can be used to meet expenses for travel, family weddings, medical emergencies, home renovation, business expansion, debt.

SBI PERSONAL LOAN UPTO 5 LAKHS BASIC DOCUMENT HOW TO APPLY SBI PERSONAL LOAN SBI LOAN

Corporate Banking application to administer and manage non personal accounts online. RBI Retail Direct portal. Block ATM Card. Register Complaint of Unauthorized Transaction. Banking Forms. Doorstep Banking. SBI General Insurance Document Download. SBI FasTag. SBI Salary Account.

How to Apply SBI Personal Loan Complete Guide on SBI Express Credit/SBI Saral YouTube

State Bank of India, a financial powerhouse, provides banking services like saving account, fixed deposits, personal loans, education loan, SME loans, agricultural banking, etc. to meet all your banking needs.. Navigation .. Invest in Mutual Fund Track your Portfolio Get Investment Ready Evaluate your Risk Appetite Mutual Fund Services .

Get It Done With SBI Personal Loan YouTube

Download Mobile App Download our top-rated app it's free,easy and smart Track your application status

How To Apply For Personal Loan In SBI Offline And Online YouTube

Click on 'Apply Online'. You will be directed to a separate page where you can apply for a personal loan. On the top right-hand side of the page, you will locate 'Track Application'. Click on it. A new pop-up will open where you will have to select 'track' and 'retail loan'.

SBI Personal Loan SBI give personal loan in low interest rate give miss call and get all

SBI personal loan applicants can track their application status by logging into- Apply Online Home Page and clicking on Application Status. The below-mentioned steps can help SBI Personal Loan applicants to check the status of their personal loan application online: Visit the official website of State Bank of India

Sbi Personal loan Apply Online SBI से 50000 का तत्काल ऋण प्राप्त करें। Agro News

1. Visit the official SBI website 2. Click on the "Personal Loans" section. 3. Now, click on "Apply Online". 4. You will find the "Application Tracker" on the top right-hand side of the page. 5. You will see a pop-up with "Track" and "Retail Loan" choices. 6. Choose "Track". 7. Now you should be able to see the status of your loan application.

Yono SBI Instant Personal Loan Apply online 2021 SBI personal loan Interest rate xpress

Features Pre-approved loan for both CSP & Non CSP Customers. It is an end to end digitized product with 24*7 availability. Customer can avail loan in 4 simple clicks. No Application fees, No documentation, No Branch visit. Instant disbursement through YONO App Customer driven process, no dependency on branch Last Updated On : Tuesday, 25-01-2022

SBI Personal Loan Status Track Application & Check Active Loan

You need to download the SBI Loans app for SBI Personal Loan tracking. Click on Personal Loan scheme that you have opted and select 'Next'. Select 'Menu' tab on the left-hand side of the app. Click on 'Track Application' from the drop-down bar. Then you enter details like- mobile number and reference number.

SBI Personal Loan 2023 Everything You Need to Know

Click here to download "Home Loan Agreement". SBI Home Loans offers a one stop solution to a home buyer. You can browse through our range of home loan products, check your eligibility and apply online! We also have a large number of SBI Pre-Approved projects that you can check out. Welcome to the largest and most trusted Home Loan provider in.

SBI PERSONAL LOAN FOR CUSTOMER MAINTAING SALARY ACCOUNT IN OTHER BANK YouTube

The eligibility criteria varies for various types of personal loan offered by SBI: Eligibility Based on Age. For Xpress Credit and SBI Quick Personal Loan, you must be aged atleast 21 years and below 58 years at the time of applying. For pension loan, you must be below 76 years and not more than 78 when the loan matures. Eligibility based on Salary